Work Hours

Monday to Friday: 10.00 - 19.00

Executive summary

Cloud costs are exploding, and 28% of your spend is still going to waste.

In 2026, AI-powered FinOps stops being optional. Instead, it becomes a competitive advantage that separates disciplined, scalable startups from those burning cash without insight.

This guide introduces five AI use cases you can implement immediately to start reducing cloud waste, alongside insights into emerging AI-driven cost challenges like GPU volatility, token billing, shadow AI, and autonomous workloads.

Startups that adopt AI FinOps early create long-term operational advantages: faster decision-making, clearer cost visibility, and more predictable cloud spend.

Those who ignore it? They’ll feel it in their burn rate.

Introduction: Why 2026 is the breakthrough year for AI-powered FinOps

Without disciplined cost management, runaway cloud bills can crush a startup’s runway and hamper growth. Therefore, FinOps, the art of responsibly managing cloud spending while enabling innovation, is crucial, especially as cloud costs surge unpredictably.

The shift that’s happening now

2026 is genuinely different. AI has moved from optional automation to the operational backbone of strategic FinOps. Predictive forecasting, autonomous optimisation, and real-time anomaly detection are now reliable, mainstream capabilities.

The question today isn’t “Should we use AI in FinOps?” but “Why haven’t we started yet?”

Compounding advantages for early adopters

Startups embracing AI FinOps gain compounding advantages: reliable forecasts replace guesswork, cost spikes get caught early, optimisation happens autonomously, and product, engineering, and finance teams align in real-time.

If your competitors still review bills in spreadsheets, your team already operates on a totally different level. For teams ready to embed AI FinOps, TardiTech offers hands-on guidance to unlock these benefits.

FinOps fundamentals for the AI era

To understand the leap AI represents, it helps to see how FinOps has evolved over the past five years.

2018 to 2020: The spreadsheet era

During this period, manual invoice tracking, quarterly reviews, and fully reactive decision-making were the norm. Consequently, issues often went unnoticed for months.

2021 to 2023: The visibility era

Dashboards and native cloud tools improved visibility, but teams were still analysing rather than acting. Reporting sped up, but decision-making didn’t.

2024 to 2025: The automation phase begins

Initial anomaly detection, rightsizing automation, and early forecasting tools help teams shift from asking “What happened?” to “What’s happening now?”.

2026: AI-driven strategic FinOps

Today’s AI-powered FinOps anticipates rather than just reports, enabling predictive intelligence and autonomous execution for continuous strategic planning.

How AI accelerates FinOps foundation phases

Inform: Shadow IT detection plus AI-generated daily reports using tools like AWS Billing MCP.

Optimise: Automated actions with governance controls.

Operate: Self-learning systems continuously improve efficiency.

However, most startups remain stuck in the Visibility Era, where waste around 28% is still the norm.

Why traditional FinOps struggles in 2026

“Manual processes won’t scale; AI is now the only practical solution.”

The complexity explosion

The complexity of modern cloud environments has exploded beyond the reach of manual FinOps workflows. In particular, multi-cloud pricing models shift hourly, serverless and container workloads fluctuate rapidly, and AI-driven tasks introduce unpredictable GPU and token billing spikes. Meanwhile, SaaS proliferation and shadow AI usages hide costly spend across teams.

These conditions make manual monthly reviews, spreadsheets, and static budgets obsolete. Therefore, the speed and scale demand AI-enabled FinOps to maintain cost control and enable growth with confidence.

The role of AI in the evolution of FinOps

AI transforms FinOps from a reactive cost-review task into a strategic, continuous capability. Rather than just interpreting bills, FinOps teams work alongside AI systems that forecast, recommend, and even execute cost optimisations more accurately than manual checks.

This is a philosophical shift. Ultimately, FinOps becomes a daily operational discipline, not a monthly cleanup job.

Five game-changing AI capabilities

Predictive forecasting with higher accuracy

Traditional forecasting relies on past behaviour. In contrast, AI-driven forecasting analyses multi-dimensional data such as seasonality, release cycles, usage spikes, and real-time consumption patterns. Consequently, the result is a far more reliable view of future spend.

For founders and CTOs, this means stronger financial planning and fewer unpleasant end-of-month surprises.

Real-time anomaly detection

Anomalies often reveal deeper operational issues: a faulty deployment, an accidental scale-out, a runaway job, or an untagged resource. Fortunately, AI-powered detection identifies deviations immediately and alerts the right stakeholders.

This eliminates the classic situation where a small mistake becomes a large invoice.

Autonomous rightsizing and scaling

Through continuous evaluation, AI assesses resource utilisation and applies optimisation strategies as conditions change. Specifically, it knows when to scale down unused clusters, rightsize underutilised instances, and recommend architectural improvements that reduce waste.

This is especially critical in Kubernetes, serverless environments, and AI workloads that fluctuate with demand.

Smarter purchasing recommendations

Purchasing strategies such as Reserved Instances, Savings Plans, and committed-use discounts often require heavy analysis. AI simplifies this by modelling hundreds of scenarios in real time and recommending the most cost-effective option based on actual usage patterns.

Context-aware FinOps decision-making

Before making recommendations, AI considers multiple factors, such as performance requirements, business-critical workloads, or compliance needs. Importantly, it does not simply push for savings. It balances cost and performance intelligently.

This is a significant step towards fully autonomous optimisation with human oversight.

Navigating the new AI cost complexity landscape

While AI unlocks powerful optimisation, it simultaneously introduces unique cost challenges.

GPU price volatility

Demand for GPUs continues to surge. Consequently, spot pricing fluctuates significantly, availability varies widely, and instance types depreciate quickly. Fortunately, AI helps model changing market conditions and identify the most sensible procurement strategy.

Token-based billing for LLMs

Token consumption is not intuitive. Surprisingly, minor variations in prompts can increase inference cost by a large margin. To address this, AI-driven monitoring detects inefficient patterns and suggests alternatives that reduce token usage without harming output quality.

Shadow AI adoption

Teams often run experiments outside official governance frameworks. Regrettably, these workloads can become expensive quickly. Even so, AI provides visibility into untracked AI usage and flags deployments that bypass cost controls.

Training vs inference costs

Training requires heavy GPU usage. By contrast, inference, although lighter, becomes expensive at scale. In response, AI helps teams model the trade-offs between running their own models, fine-tuning, or adopting managed services.

SaaS and licensing waste

Beyond cloud infrastructure, AI helps track underutilised licences across the business and identifies opportunities to consolidate tools early. Ultimately, this expands FinOps beyond cloud infrastructure into total technology spend.

Modern tools like autonomous optimisation platforms and intelligent cost governance engines have made these capabilities significantly more accessible. Indeed, Tangoe’s recent review of AI-driven hyper-automation for cloud cost optimisation aligns closely with what we see on the ground, particularly for teams scaling rapidly.

The benefits of AI-driven FinOps for startups

AI is no longer a nice enhancement to FinOps. For startups and scale-ups, it is becoming essential to stay financially disciplined while moving at speed.

Stronger cost governance without slowing delivery

Founders often face a trade-off between financial discipline and engineering velocity.

However, AI removes this tension by automating cost monitoring, resource validation, anomaly detection, and rightsizing. As a result, engineering teams stay focused on innovation while the business gains full control over spend.

This creates a healthier partnership between technology and finance, which is crucial during rapid scaling.

More accurate forecasting across unpredictable growth

Startups rarely follow linear patterns. In fact, usage can double overnight. Furthermore, new features can reshape consumption, while fundraising rounds can trigger sudden platform expansion.

Fortunately, AI-driven forecasting is adaptive. By interpreting real usage signals, seasonal patterns, traffic shifts, ML model behaviour, and emerging trends, it delivers more reliable budget planning and fewer financial shocks.

Faster detection of waste and inefficiencies

Within minutes, AI identifies dormant resources, over-provisioned clusters, redundant test environments, and inefficient inference patterns. In contrast, traditional manual reviews often uncover these issues at the end of the month, by which time it is too late. Therefore, real-time visibility means waste is removed before it becomes expensive.

Better cost-to-performance balance

Cutting costs without considering performance risks, outages and user frustration.

Fortunately, AI optimises both cost and performance at the same time. By evaluating workload behaviour, latency patterns, utilisation trends, and service dependencies, it recommends actions that maintain or improve performance while reducing spend. This approach protects the customer experience during optimisation.

Reduced engineering burden

Engineers are often tasked with reviewing cloud bills, finding cost anomalies, or manually tuning resource configurations. Unfortunately, these activities drain time and rarely deliver the strategic benefit the business expects.

However, AI automates most of this work. As a result, engineers spend more time building features and less time troubleshooting cloud costs.

Expanded visibility beyond cloud infrastructure

Startups increasingly rely on paid APIs, SaaS platforms, AI services, usage-based data tools, and licensing agreements. Therefore, AI enhances visibility across the entire technology stack, not only the cloud bill.

This is vital for finance teams who need a full picture of recurring operational costs.

Faster decision-making for leadership

Founders, CTOs, and CFOs can access real-time dashboards that summarise cost drivers, forecast future spend, identify risks, and highlight savings opportunities. Consequently, decisions that used to require a full analysis can now be made in minutes.

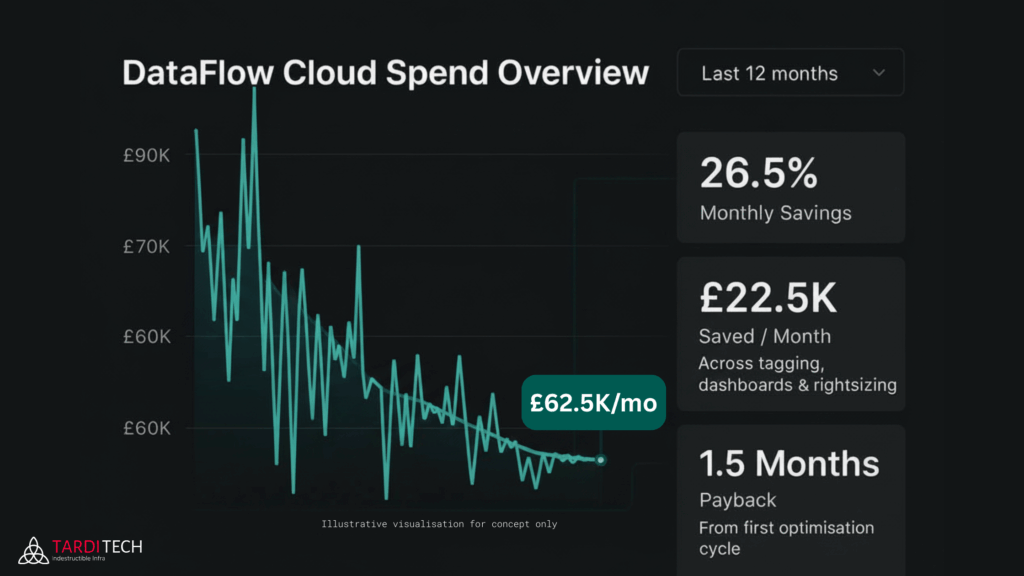

Real-world case study: dataFlow

A Series A SaaS startup with £2.5M ARR and 15 engineers reduced cloud spend from £85K to £62.5K per month over 12 months (26.5% savings).

•Phase 1: Tagging & cleanup saved £12K/month

•Phase 2: Dashboards & forecasting saved £6.5K/month

•Phase 3: Rightsizing and multi-cloud optimisation saved £4K/month

The team achieved a budget variance under 5%, a cost per customer of £1.88, and payback in just 1.5 months.

The key takeaway: visibility drives accountability, quick wins build momentum, and forecasting enables confident growth.

Final thoughts: Make AI FinOps your strategic edge

Cloud costs are no longer just a finance concern in 2026; they’re a vital strategic lever. Startups that embrace AI-driven FinOps shift from reactive cutting to proactive, insight-driven decision-making. Real-time visibility, predictive forecasting, and intelligent optimisation enable teams to experiment freely, scale confidently, and align every infrastructure dollar with business outcomes.

The payoff? Not just lower bills, but faster innovation, smarter growth, and a credible story for investors. Embedding FinOps into your company DNA creates operational discipline that compounds as you scale.

The choice is simple: start now, build your AI FinOps capability, and within 12 months, see savings and strategic impact transform your business.

Learn how TardiTech helps scale-ups embed FinOps into organisational DNA for predictable, sustainable growth.