Work Hours

Monday to Friday: 10.00 - 19.00

FinOps Fails Quietly, Not Dramatically

Most FinOps problems do not show up as chaos on day one. They show up as small delays, unclear ownership, and conversations that start too late. Costs are reviewed after decisions are made. Tension builds between engineering and finance. Leadership steps in only when numbers already feel uncomfortable.

Teams often assume they have a tooling problem. In reality, they usually have a decision-timing problem. That gap is visible in FinOps in the real world, where late signals, unclear ownership, and slow decisions create issues long before costs feel out of control.

This article looks at:

- The FinOps problems teams think they have

- The issues they actually run into as they scale

- What successful teams changed in practice

- The pattern behind FinOps that actually works

We see this clearly in practice. In our work on How AI is transforming FinOps in 2026: strategic optimisation for startups, the biggest cost issues were not caused by missing tools, but by signals and decisions arriving too late.

This is FinOps in practice, not theory.

What FinOps Looks Like on Paper

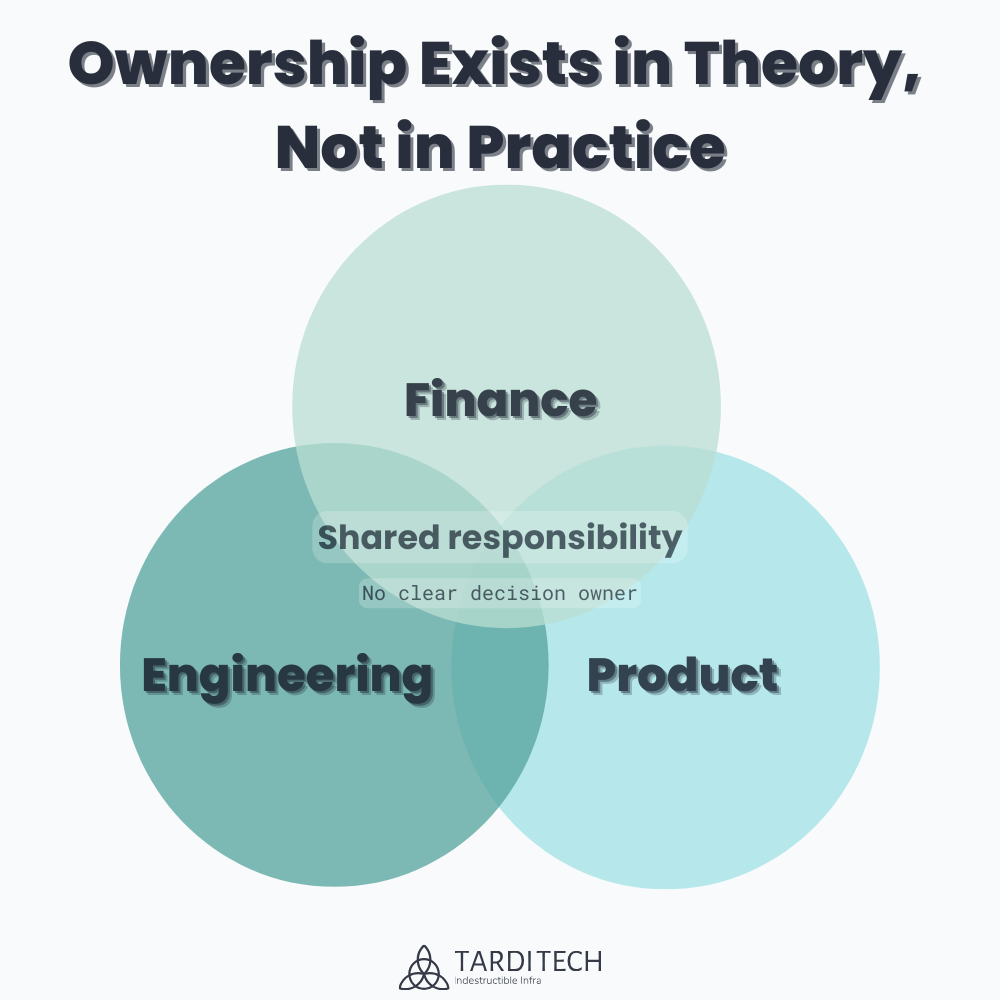

As defined by the FinOps Foundation, FinOps is a practice that brings engineering, finance, and business together to make better cloud spending decisions.

On paper, this usually means:

- Cost visibility dashboards

- Budgets and alerts

- Shared responsibility

- Monthly reviews

All of this is necessary. None of it is sufficient on its own.

Dashboards do not fix late signals. Shared responsibility does not automatically create clear decisions.

The FinOps Problems Teams Think They Have

When teams describe their FinOps struggles, the same themes come up:

- “We need better dashboards.”

- “Engineering needs to be more cost-aware.”

- “Finance does not understand the architecture.”

- “AI workloads are making spend unpredictable.”

These concerns are valid. But they are surface symptoms, not root causes.

Most teams focus here because these problems feel concrete and solvable. The real issues show up one layer deeper.

The Problems Teams Actually Run Into (From the Field)

Across scaling startups, the same FinOps breakdowns appear again and again.

No Cost Owner per Service

Responsibility is shared in theory, but decision ownership is unclear. Costs float across teams until leadership is forced to intervene.

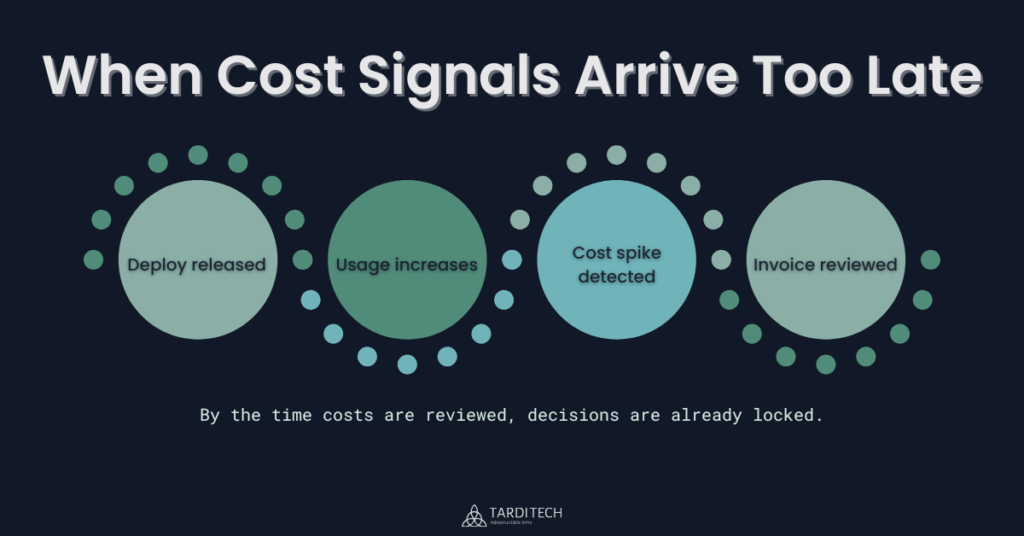

Bills Are Reviewed Too Late

By the time finance raises a flag, the deploy has shipped, the traffic spike has passed, and the architecture choice is already locked in.

Engineers Do Not Trust the Data

Dashboards show numbers without context. When costs cannot be tied to code, services, or decisions, the data is ignored.

Finance Sees Totals, Not Drivers

Finance sees the invoice. Engineering sees the system. Without translation between the two, conversations become defensive instead of productive.

AI Workloads Break Old Cost Models

Usage is elastic. Experiments move fast. Traditional budgets lag behind reality. Costs feel unpredictable because signals arrive too late.

These challenges are widely recognised as common pitfalls when adopting FinOps, especially in fast-scaling teams.

They are not people problems. They are system design and timing problems.

Shared responsibility without decision ownership often delays action, even when the data is visible.

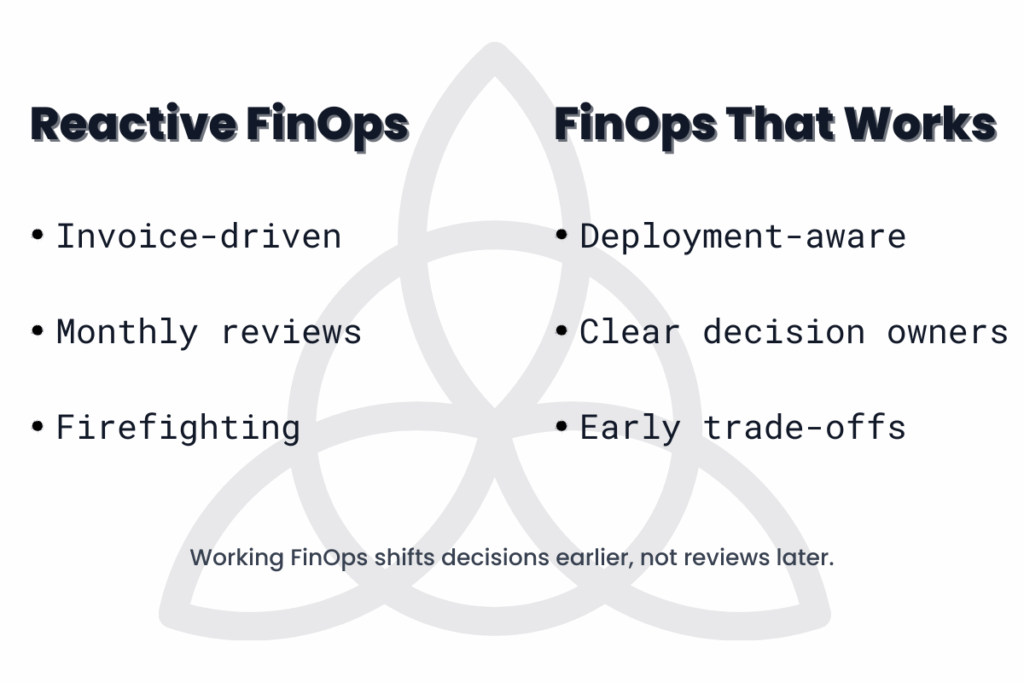

What Successful Teams Actually Did

When FinOps starts working, it is rarely because of a new tool. It is because teams change how and when decisions happen.

What Failed First

- Monthly-only cost reviews

- Shared ownership without clear decision rights

- Too many dashboards with no clear signal

What Worked Eventually

- Clear cost ownership per service or workload

- Signals tied to deployments, not just invoices

- Fewer tools, better questions

What Changed Culturally

- Costs discussed as trade-offs, not mistakes

- Engineers involved earlier, not blamed later

- Finance included in planning, not just reporting

At this stage, FinOps stops feeling reactive and starts supporting delivery.

This shift is less about tooling and more about when decisions happen.

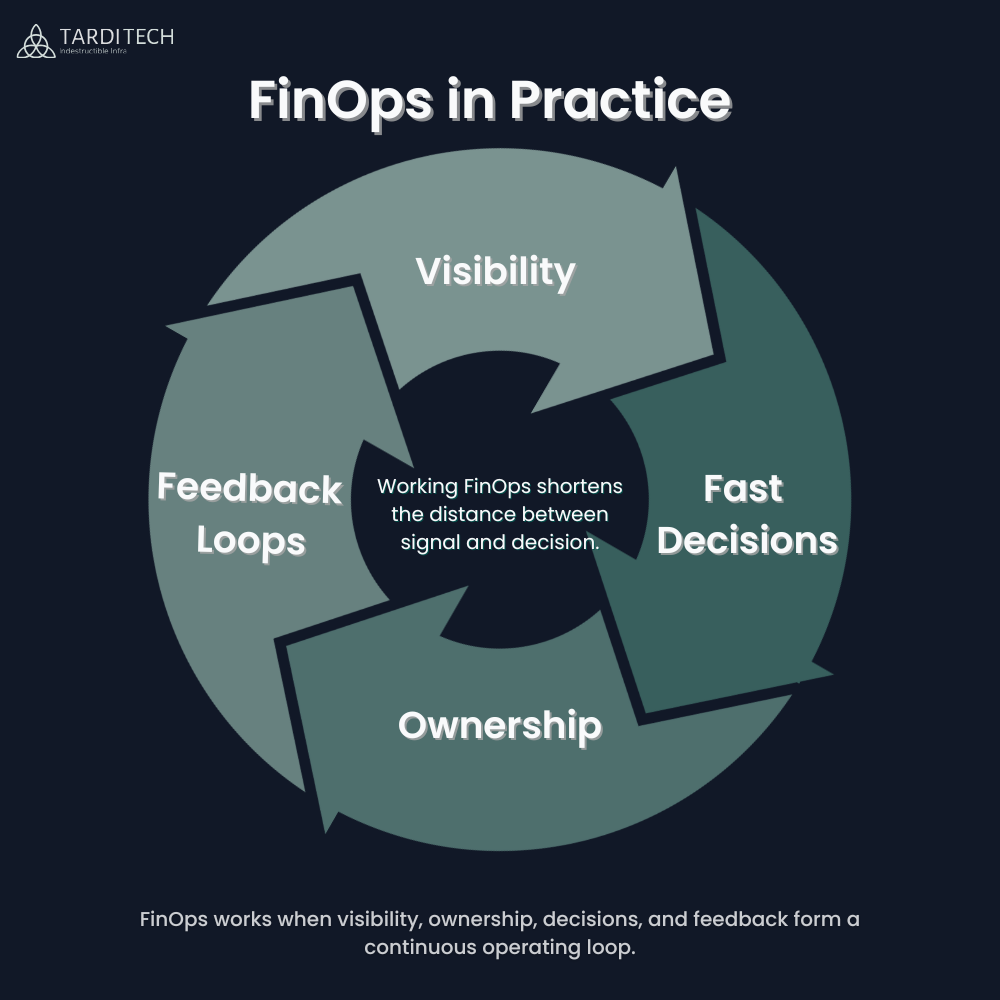

The Pattern Behind FinOps That Works

When you strip away tools and cloud providers, the same pattern appears:

- Visibility arrives too late

- Ownership exists in theory, not practice

- Decisions are reactive instead of contextual

- Feedback loops are slow or missing

Mature FinOps teams do not eliminate cost spikes. They shorten the distance between signal and decision.

That is the real shift.

The FinOps Reality Check

Not sure where your FinOps process breaks down? This quick self-assessment helps you identify whether issues come from timing, ownership, decision flow, or feedback loops.

FinOps in Practice for 2026: A Practical Reset

If you are scaling this year, focus on these actions:

- Identify where cost signals arrive too late

- Assign decision ownership, not just reporting roles

- Track patterns, not only spikes

- Connect cost signals to delivery events

- Review costs as part of planning, not post-mortems

You do not need perfect forecasts.

You need earlier awareness and calmer decisions.

FinOps Is an Operating Habit, Not a Toolset

FinOps maturity is not about control. It is about confidence.

Real-world FinOps case studies consistently show that teams with similar cloud spend end up with very different outcomes depending on ownership clarity, decision timing, and feedback loops.

When teams understand costs earlier, decisions improve, tension drops, and growth feels intentional instead of risky.

That is what FinOps in the real world looks like when teams focus on timing, ownership, and feedback instead of tools.

Ready to Diagnose Where Your FinOps Breaks?

If you are unsure where your FinOps decisions break down, start by examining timing, ownership, and visibility. Those gaps usually explain more than any dashboard ever will.